A Systematic Investment Plan, or SIP, has become one of the most trusted ways for ordinary investors to build long-term wealth. What makes SIPs powerful is their ability to transform small, consistent monthly investments into a significant corpus over time.

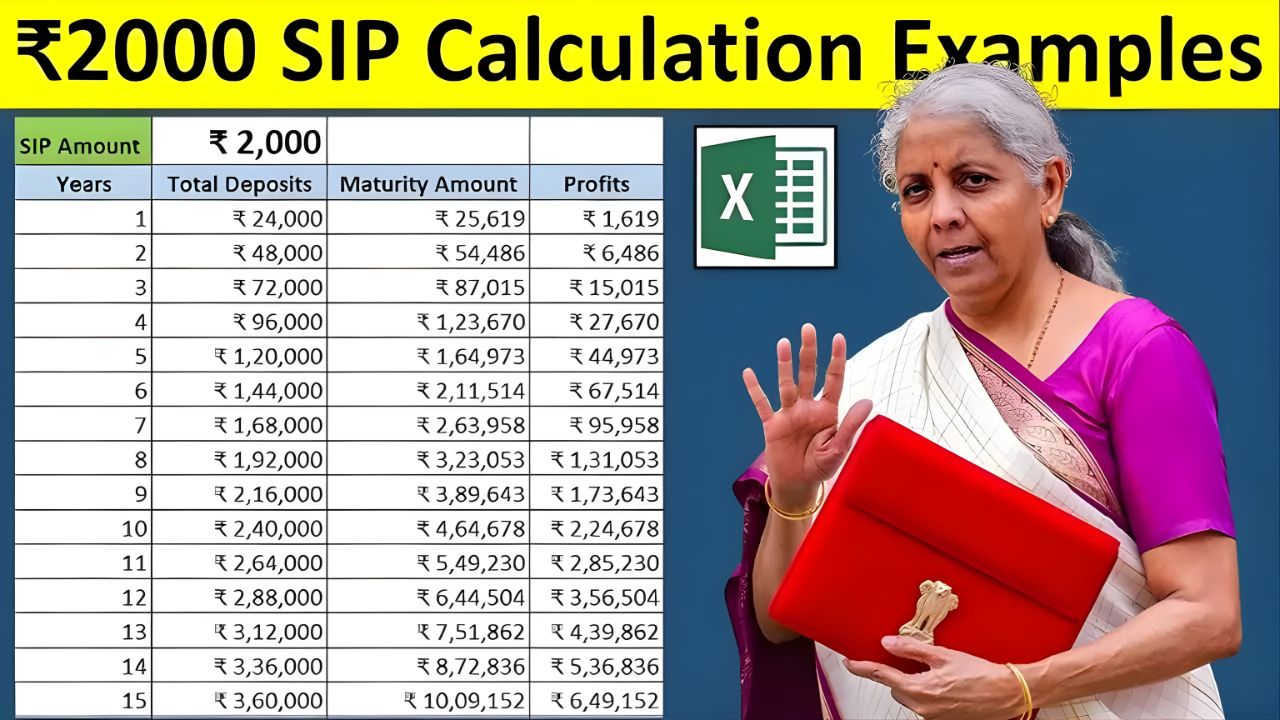

A recent calculation shows that a simple monthly SIP of ₹2,000 can grow into an impressive ₹7.6 lakh, highlighting how disciplined investing can create financial security for the future.

How a Small SIP Creates Big Wealth

The magic behind SIP growth lies in compounding. When you invest ₹2,000 every month, the money not only grows through market returns but every rupee invested earlier also starts generating additional returns.

Over time, this compounding effect becomes stronger and leads to exponential growth. Even if an investor begins with a small amount, long-term consistency can create a substantial outcome.

The Power of Time in SIP Investments

Time plays the most important role in wealth creation. The longer the investment period, the greater the benefit from compounding. In the example where ₹2,000 grows to around ₹7.6 lakh, the calculation assumes a steady long-term return that compounds every year. This shows that patience and continuity are far more important than the size of the monthly SIP.

Why SIPs Are Ideal for Beginners

SIPs are especially popular among new investors because they don’t require large sums. By investing just ₹2,000 monthly, anyone can start building a disciplined habit. SIPs also protect investors from market volatility by averaging out the purchase cost over time, reducing the risks associated with market ups and downs.

A Practical Step Toward Financial Freedom

For many individuals, SIPs are the first step toward achieving financial goals such as education, home purchase, retirement or emergency funds. A monthly contribution that seems small today can become a life-changing amount in the future. By increasing the SIP amount gradually as income grows, investors can further accelerate wealth creation.

Why Everyone Should Consider Starting Early

The example of ₹2,000 turning into ₹7.6 lakh is a strong reminder that starting early gives investors a big advantage. Delaying investments, even by a few years, can significantly reduce the final corpus. Beginning early, staying consistent and allowing time to work its magic form the foundation of successful wealth building.